21.03.2023

CSA-Update

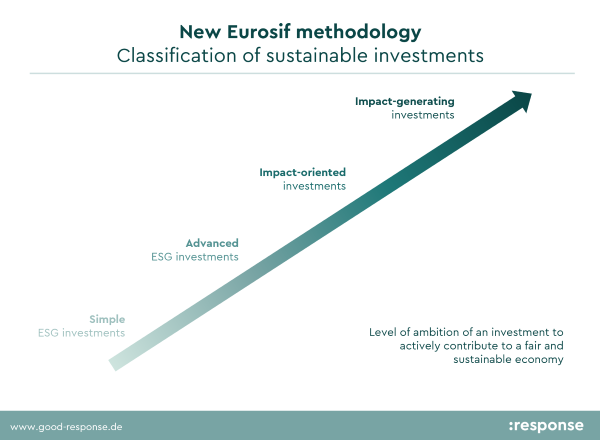

ESG ratings are becoming more and more relevant – the combination of financial data and sustainability-related data has become almost commonplace for corporate finance. Investors are relying on these ratings more and more. For us, ESG Rating Adisory has been a topic since the turn of the millennium, and we have already accompanied several companies to industry leadership.

One of the leading ESG ratings is S&P Global’s Corporate Sustainability Assessment (which remains the basis for the Dow Jones Sustainability Indices, for example). In the past, formulating a policy on sustainability goals was often sufficient to get a good rating. This has changed, because the CSA in particular increasingly evaluates actual sustainability performance, i.e. how ambitiously targets are set and whether they are actually achieved.

S&P Global has now published the methodology for this year’s rating. In addition to some streamlining of the data, it is interesting to note that Real Estate has been split into two sectors: Real Estate Investment Trusts, and Real Estate Management & Development. Fun fact: for the first time, tenant welfare and corresponding measures are considered.

Also important: it has long been felt that ESG ratings are struggling to keep pace with developments in standards and EU regulations. But this is not true: SBTi, CDP, TNFD, and TCFD will all be integrated – as well as forward-looking data for investors. Reporting will be extended to include taxonomy and the decarbonization of fleets, and a lot of minor changes in criteria and weightings will be integrated: