Is your financial company affected by the European Sustainable Finance Disclosure Regulation (SFDR), and therefore has to disclose its sustainability at company and product level?

:response supports you throughout the entire disclosure process according to the SFDR, including its extension to the disclosure of Principal Adverse Impacts (PAIs).

What is the SFDR?

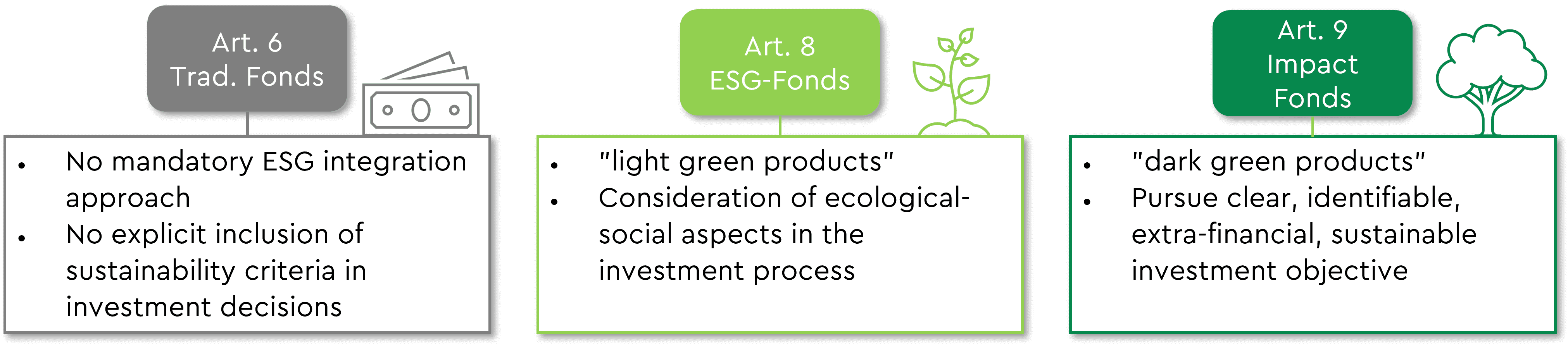

The SFDR is an EU regulation put in place to increase transparency in the market for sustainable investment products and prevent greenwashing. The regulation therefore implements a core concern of the 2018 EU Sustainable Finance Action Plan. With the SFDR, financial actors must for the first time disclose comprehensive information on ESG metrics and risks at both company- and product-level. This transparency should provide investors with essential information to make more sustainable investment decisions, and thus steer financial flows towards sustainable transformation.

Who is affected by the SFDR?

To whom does it apply?

1. Financial advisors

2. Financial market participants

Disclosure is required for:

Sustainability risks

in the areas of Environmental, social, and governance, capable of affecting the value of investments.

Disclosure on whether sustainable investments comply with the DNSH Principle.

Key adverse impacts at company and product level: Principle Adverse Impacts (PAI) from January 2023.

Adverse impacts of investment decisions on environmental, social, labour, and human rights concerns

Measures to address adverse impacts

Our SFDR services for you:

Development of a Sustainable Investment Framework

Analysis of sustainability risks

Analysis of key negative impacts at company- and product-level, and disclosure using key performance indicators (PAIs)

Analysis of portfolio composition according to SFDR criteria

Advice on the development of SFDR Article 8 ESG funds

Advice on the development of SFDR Article 9 impact funds